Don't Do Me Like That

Posted by Mike Allen on Thu, 08/29/2019 - 10:35

The older I get the more I find celebrities interesting. The things we see in the tabloids present them as caricatures of real people, and everything they face and go through seems to be normal life on a larger flashier scale.

For example, a negligent parent may lead to a drinking habit for average Joe, but for Elton John it fueled a lavish, loud rock career and substance abuse problem that nearly killed him. Slightly bigger scale.

The same seems to go for their planning needs. 2017 saw the fall of more than a few music legends who left legacies up for grabs to friends, families, and associates. Unfortunately, mortality wasn’t front of mind for many of these stars, and they either failed mostly or completely in setting up a valid estate plan to pass along what they had built.

The Inside Scoop

Posted by Mike Allen on Thu, 08/29/2019 - 10:26

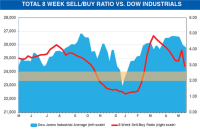

Global markets have continued to skid for the month of May. The MSCI All Country World Index is down 5.76% according to yahoo finance as of 5/29/19. With trade talks continuing to take center stage and spook the markets, stock investors are looking around to see whether or not fears are warranted.

Automation

Posted by Wesley R. Nicholson, Mike Allen and Aaron Everdyke on Fri, 05/03/2019 - 15:16

Last week Mike touched on the fact that six stocks have made up almost 40% of the S&P 500’s returns over the last five years, and it should be no real shock that all six of those companies are tech giants. If we think about how technology in general has changed our lives over the past 30 years; It’s astonishing. Things we take for granted now, were pie-in-the-sky ideas in the early 90s. Computers in general were more of a luxury item, laptops even more so. The internet was starting to gain traction with just 50% of Americans using it 20 years ago, and cell phones took second fiddle to landlines. Compare that to today where 90% of Americans use the internet, and it’s a safe bet that much of that internet usage comes from a smart phone. The moral of the story? Technology is here to stay, and it is only becoming more and more intrenched in our daily lives.

Tax the Rich

Posted by Wesley R. Nicholson, Mike Allen and Aaron Everdyke on Wed, 04/17/2019 - 13:04

Since no one can escape politics these days anyway we felt we may as well throw our hat in the ring by discussing a concept that get’s almost media attention as President Trump’s twitter account: the 1%.

Grade Inflation

Posted by Wesley R. Nicholson, Mike Allen and Aaron Everdyke on Wed, 04/17/2019 - 13:01

Last July we wrote a piece called Interesting Interest which touched on the state of consumer debt and the effect rising rates might have. Now, nine months later many of the things predicted in that post have come true. In February consumer debt officially climbed to over $4 trillion; with credit card debt increasing by $41 billion between November and December to a whopping $1.03 trillion. That coupled with the interest rate hikes saw credit card interest payments climb about $13 billion from 2017 to a total of $113.3 billion. Despite all of that, on the surface it appears that everything is still in pretty good shape. According to the Federal Reserve, mortgage and credit card delinquency rates are still 2% below where they were in 2008. On the other hand, auto loan delinquency has continued to trend upward nearing all-time highs. Now what does this mean? Well in a recent piece by Bloomberg, Adam Tempkin dives into how “grade inflation” might be causing this disparity.

Witch Hunter

Posted by Wesley R. Nicholson, Mike Allen and Aaron Everdyke on Wed, 04/17/2019 - 13:00

I am sure many of you remember the soothsayer’s warning “Beware the Ides of March” in Shakespeare's Julius Caesar. Those words have had a long-standing impact on the date causing a negative connotation in many people's minds. Unfortunately, this year the Ides of March also fell on a Quad Witching date... Despite the spooky sounding name Quadruple Witching isn’t as bad as it sounds.

Mega Deals

Posted by Aaron Everdyke on Fri, 03/08/2019 - 16:12

It’s that time of year again, Spring Training has begun and we’re under a month away from opening day in baseball, not that you’d know it with the single digit temps we’re experiencing here. As many of you know I am a huge baseball fan and with my Red Sox coming off a world series championship the 2019 season can’t begin quick enough! While I know not all of you are baseball fanatics, the sport can be a very interesting one to look at from a statistical standpoint and a finance standpoint.

Use Tax

Posted by Aaron Everdyke on Fri, 03/08/2019 - 16:11

There is little more instantly satisfying than shopping online. You skip the crowds, have access to countless reviews and have it delivered to your door in no time. Couple that with the ability to occasionally avoid that pesky 6.5%† sales tax and it seems like a no brainer. I mean who doesn’t want to get an instant 6.5%† discount on a purchase?

Harder to get Paid

Posted by Aaron Everdyke on Fri, 03/08/2019 - 16:10

It is a well-known fact that it is getting more and more difficult to retire. Long gone are the days where you could count on pensions and social security to see you through retirement. Now we are in a world where the average person is responsible for their own retirement by investing in vehicles like IRAs and 401ks which will become the primary retirement funding sources. If that change didn’t make things difficult enough, now consider the fact that over the past 30 years you have had to take increasingly more risk to generate a return that will grow your assets and allow you to use them for income in retirement.

A Guide to Federal Veterans Benefits

Posted by Aaron Everdyke on Fri, 03/08/2019 - 16:07

There are two separate agencies overseen by the U.S. Department of Veterans Affairs (VA): the Veterans Health Administration and the Veterans Benefits Administration. The Veterans Health Administration determines eligibility for medical benefits, while the Veterans Benefits Administration determines eligibility for financial benefits. The agencies operate independently and have separate eligibility criteria for their programs. As such, if you qualify for medical benefits, it does not guarantee that you will qualify for financial benefits.

Eligibility for medical and monetary benefits depends on your discharge status. Generally, a veteran will satisfy the discharge requirement if his or her classification is “honorable” or “general under honorable conditions.” A veteran with a discharge classification of “other than honorable conditions,” “bad conduct,” or “dishonorable” may not be eligible for VA benefits.