It is a well-known fact that it is getting more and more difficult to retire. Long gone are the days where you could count on pensions and social security to see you through retirement. Now we are in a world where the average person is responsible for their own retirement by investing in vehicles like IRAs and 401ks which will become the primary retirement funding sources. If that change didn’t make things difficult enough, now consider the fact that over the past 30 years you have had to take increasingly more risk to generate a return that will grow your assets and allow you to use them for income in retirement.

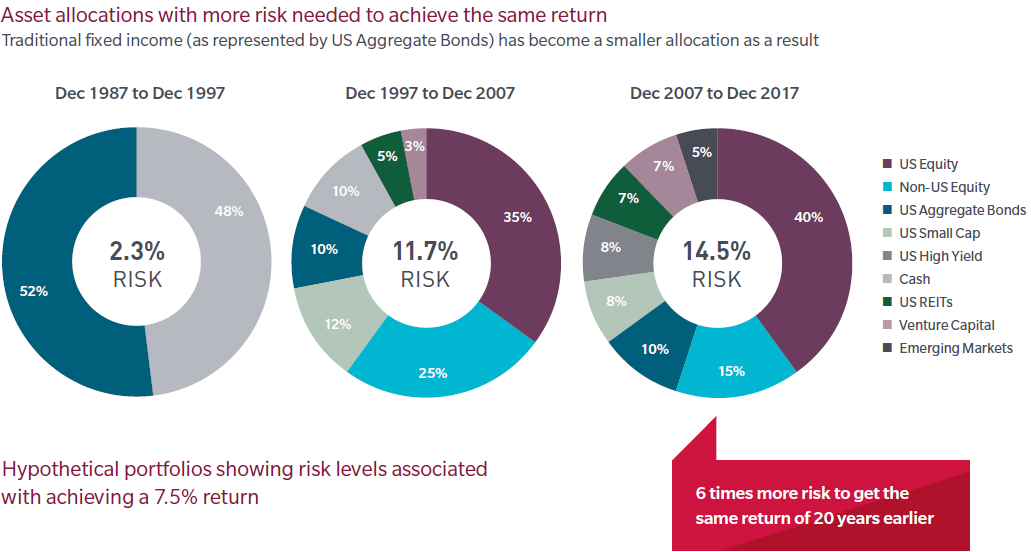

As interest rates have decreased since 1987, the income that safer investments can provide to a portfolio has also come down and forced investors into more risky portfolios to achieve reasonable market returns. The Fund Company MFS recently released a piece showing how much a portfolio that had returned 7.5% has changed over the past three decades.

From MFS’ Are Investors Piling on Risk in Search of Returns?

As you can see, a portfolio comprised of only US Bonds and Cash comfortably gave you a 7.5% return back in the 80’s and 90’s with almost no risk to your investment principle. To generate that return recently you needed a portfolio comprised of 8 different sectors, where cash and US bonds could only afford to make up 10%. This portfolio would be much too volatile for most retirees forcing many to accept lower average returns in exchange for a portfolio that they are comfortable with.

We wanted to share this because it often feels like making money should be easier but considering how much more risk is needed to achieve what used to be easy returns and that the last decade was the worst for bonds since the 1960’s we need to temper our expectations.