2018 has been a confusing year for investors and the month of October pretty much summed it up. We’re up, we’re down, we’re sideways. The S&P is at new highs, wait, no, it’s a correction. The economy is good, the FED is nuts. Who knows what to believe.

In times like this, the place we look for solace is the bond market. We’ve written many pieces about bonds being “smarter” than stocks. And we say this because bonds behave in a much more technical nature than stocks. They are obligations of the companies or governments that issue them and their returns can actually be calculated for a given scenario. Their pricing is primarily affected by interest rates and credit quality.

Right now we know that interest rates are rising so that’s going to have a negative impact on most bond prices.

Credit quality, however, doesn’t seem to be in question and that is a positive sign to us. Please read on for our supporting argument.

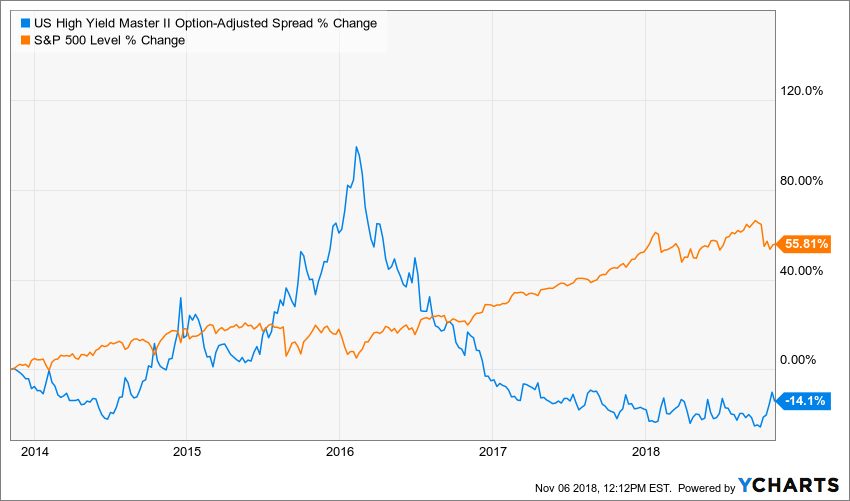

If you look at the chart below, you’ll see the S&P 500 in orange and high yield bond spreads in blue.

High yield spreads basically show how much you get paid for holding junk bonds. The more you get paid, the higher the market thinks your risk is for holding that bond.

You can see back at the beginning of 2016 we had some similar dips in the stock market to what we just experienced but you’ll notice the blue spread line went through the roof. There was real concern at that time about companies prospects and the likelihood of future defaults.

Fast forward to this past October, which also involved a market correction, and you’ll see that spreads barely varied outside of their “normal” wiggling.

To us this indicates that, despite what the news would have you believe, the bond market doesn’t seem to be too worried about even the companies with the lowest credit quality defaulting on their debt.

Now you’ll note that last time bonds got all worried, nothing bad happened, so don’t look at this as a predictor. We’re just pointing out that the bond market thinks companies are in better shape now than they were last time there was a stock market correction.

That, along with continuing economic growth and strong company earnings gives us reason for optimism in the medium and long term.