All Time High

Last month we saw the S&P 500, Dow Jones Industrial Average, and NASDAQ post new all-time highs. Now you’d think this would be a good thing, but this tends to make people more nervous about the road ahead than happy about a good year gone by. Many get stuck with the idea of what goes up must come down, or may also feel like they “missed out” on stock climbs. This can create conflicted feelings of wanting to jump into stocks, but at the same time you’re scared to death the market is going to correct. Heads spin, emotions run wild, and a weird uneasiness is often the ultimate result. Relax, you’re not alone.

The simple truth is, at any point, stock prices are going to do one of two things: go up, or go down. One of the most common questions we have been getting is: “If they’ve already gone up for a month or two aren’t they more likely to go back down?” The short answer is maybe, but not necessarily.

If these thoughts are haunting you, here’s some numbers to meditate on.

- In the 2010’s the S&P spent 118 days at new highs. That’s roughly 10% of the time.

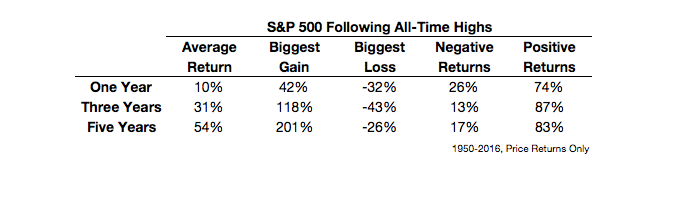

- And here is a chart showing how the S&P has performed following all-time highs since the 50’s.

1Source: http://finance.yahoo.com/news/dont-be-afraid-of-all-time-highs-in-the-st...

I don’t know about you, but understanding that those numbers are averages, that’s not all that terrifying.

Trying to not invest at an all-time high may seem wise, but ultimately is trying to time the market, and we all know how that works out. At times like these it’s important to look a little deeper and remember why we’re investing.

If you’re that afraid of losses in the near term maybe you don’t need that much risk in your portfolio and you’re better suited in a different asset class anyway. But if you have a long enough time horizon in mind for the money you’re putting to work, then investing at new highs is part of the deal. Unfortunately, we don’t get to see the peaks until after they’ve passed. And as I always say, if stocks didn’t hit new highs every so often there wouldn’t be many people looking to invest in them.

All indices are unmanaged and investors cannot invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. The Dow Jones Industrial Average (DJ IA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange (NYSE) and the NASDAQ.