2018 has been an interesting year for global markets thus far. We’ve seen declines in almost every foreign index while getting relatively good economic data from our developed friends from across the pond. What gives? Are Trump’s tariff talks really hurting businesses around the world?

We don’t think so, but they do seem to be affecting something else very important to foreign investments which is currency. With talks of tariffs putting stress on developing economies, their currencies aren’t worth as much in the us because it will take more of their dollars to net one USD. For example, if 100 widgets cost a company in India 5000 Rupees to make and they got $300 when they sold those in the US. If we impose a tariff of 25% then they only get $225 for those same goods that still cost them 5000 rupees to make. So, it’ll take more rupees to make that same $300 as before so their currency has effectively lost value compared to ours.

And while most of the tariff talk is still just talk the currency exchange markets have started pricing some of this in.

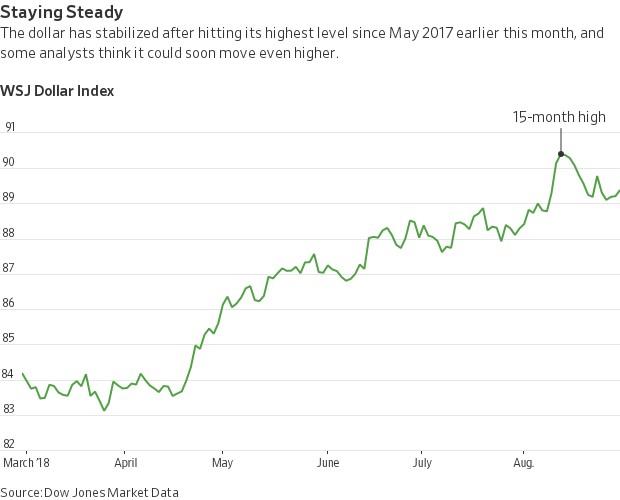

Looking at a chart from the Wall Street Journal, we can see how this happening around the world has pushed the dollar to multi-year highs.

What this means to us as investors is two-fold:

- Stocks denominated in foreign currencies are worth less to us right now. This is a big reason we’ve seen losses in foreign stock indexes like the -5.7% return we’ve seen from the MSCI ACWI ex US index.

- This could be tough for developing markets because a lot of their debt is denominated in US Dollars because it is more stable than their local currency. Right now, though it is much more expensive for them to pay off their debt than it was at the beginning of this year.

The reason we present this is just to give some explanation of what’s going on. Currency fluctuations are normal and are part of the deal when investing internationally. This move is hurting right now, but when the dollar weakens it will help foreign investment performance relative to ours. Just know that the numbers you see for foreign investments doesn’t mean that all of their companies are doing poorly this year. In this case there are bigger forces at play.

As always, keep calm, and stay diversified.