Investing at its root is marrying goals with expectations. The goals part can be difficult, but more often it is the expectation for what our investments will do that can allude us.

Most people this year have taken notice that the broad market has performed pretty well. What we look at now is where that performance came from.

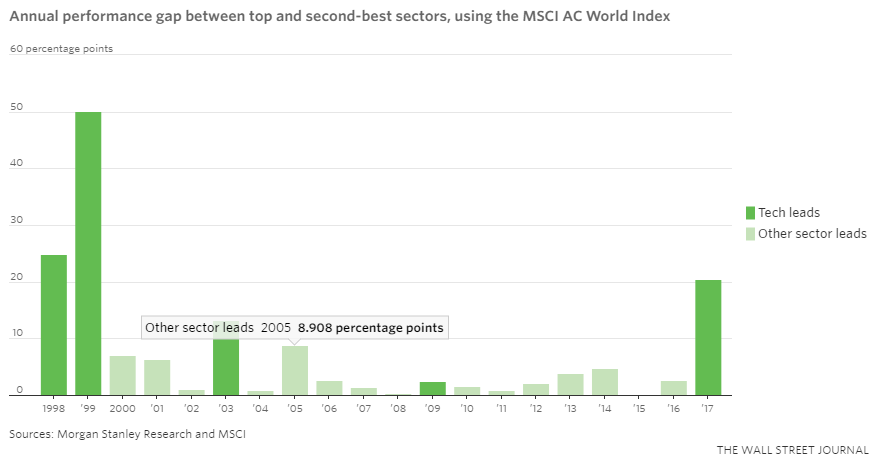

Technology companies have outperformed the next best segment in the market this year by the largest margin since the 1999 tech bubble.

Tech may seem an obvious choice of where to put your money to some with the daily innovation we see and the amazing things tech companies are accomplishing, but I want you to look at the graph below carefully and see what you notice.

What I notice is that tech has not been the best performing market segment in 8 of the last 10 years and in 15 of the last 20 years. Would you say that some innovation has happened since 1999? I would think so.

The moral of the story is just because something “makes sense” one year like tech leading doesn’t mean you should abandon diversification and allow yourself to assume that that’s always going to be the case going forward. It’s especially hard to resist this stream of thought with tech because it probably has the largest effect on our daily lives and is the fastest changing group of companies out there.

And fear not, if you own equities in your portfolio you probably have plenty of exposure to the tech sector. For example, right now four tech companies (Tencent, Alibaba, Taiwan Semiconductor, and Samsung) make up 17.4% of the MSCI Emerging markets index. Six of the S&P 500’s top 10 holdings are tech companies combining for 13.55% of that index and if you’re a growth investor those same 6 stocks make up 23.79% of the Russell 1000 Growth Index. The overall percentages for those last two indexes is roughly ten percent higher than those numbers as well.

Big numbers like we’ve seen from tech this year can give some the itch to make changes. Has tech changed the global paradigm forever? Will markets never be the same and will giants like Amazon, Apple and Google change the global investing landscape as we know it? I would purport that they already have, and that still doesn’t mean that they’re the only thing you should own. Lots of companies make the world go ‘round.

Stay diversified my friends.